Questions/Answers (FAQs)

- What is the Emissions Trading System?

- What is the Spanish Section of the Union Registry?

- How can I access the public information?

- How can I access the Registry?

- What should I do if I forget my EU login password?

- What is an emissions allowance?

- What are the main Units contained in the Registry?

- What is the allocation of emission allowances?

- Where can I find the different user manuals?

- Who has the obligation of opening an account in the Registry?

- What is a Legal Representative?

- What is an Authorised Representative and what are their roles?

- How many Authorised Representatives are needed to open an account and what are their roles?

- Can there just be one Authorised Representative registered in the account? Check, Four-eye principle (Double validation)

- Can an LR be an AR at the same time?

- What is an account holder?

- What is an installation operator?

- What is an EU account?

- How can I access the account information in the Registry?

- What is compliance?

- How can I check the compliance status?

- When is the compliance history updated?

- What is the deadline for surrendering allowances?

- Is it possible to surrender the allowances before 1 April, even though the Competent Authorities have not validated the verified emissions?

- When are the verified emissions recorded in my account?

- How can I check the verified emissions and the compliance within the Registry?

- What happens if the verified emissions data is not recorded in the Registry?

- Can I request that Iberclear issue a certificate?

- What is the fee for a certificate?

- What must I do to amend any data held on the Registry?

- Can I abort a transfer?

- What transactions can be cancelled?

- Can I perform transactions outside the trusted account list?

- Do I have the obligation to update the documentation of the account?

- What are the possible statuses of an account?

- What is an excluded account?

What is the Emissions Trading System?

The EU emissions trading system was conceived as a tool to facilitate the fulfilment of the commitments undertaken by the European Community after the approval of the Kyoto Protocol and to acquire experience in the participation in an emissions trading system before the entry into force of said Protocol. On 13 October 2003, Directive 2003/87/EC of the European Parliament and of the Council was approved, establishing a scheme for greenhouse gas emission allowance trading within the Community and amending Council Directive 96/61/EC. In accordance with the provisions set forth in the Directive, the EU emissions trading system commenced operations on 1 January 2005.

The emissions trading system in Spain

The trading of greenhouse gas emissions is governed by Law 1/2005, of 9 March. It started on 1 January 2005 as a fundamental measure to encourage the reduction of CO2 emissions in the industrial and electricity generation sectors.

What is the Spanish Section of the Union Registry?

The purpose of the national registries is the exact accounting of the issue, ownership, transfer and cancellation of emissions allowances.

In the European Union, the national registries were established with a dual role: guarantee the accounting within the framework of the Kyoto Protocol and ensure the correct functioning of the European Union Emissions Trading System (EU ETS).

The national registries of emissions allowances of the member states of the European Union are integrated within a common platform together with the Union Registry (managed by the European Commission) known as the Consolidated System of European Registries (CSEUR). In spite of this consolidation, the accounts held on the Union Registry continue to be independently managed by each Member State through its National Administrator (each Member State is responsible for a section within the registry, comprising, for example, the accounts of the fixed installations located within its territory, those of the aircraft operators it has been assigned, those of any individual, business (trading), verifier, external platform and surrender by means of auction opened at the request of any interested party and those owned by this State).

How can I access the public information?

After gaining access to the Registry, at the top left there is an option which is "Public Information", as well as via the website for the Ministry for the Ecological Transition and the Demographic Challenge:

How can I access the Registry?

There are different ways to access the Spanish Section of the Union Registry:

- By clicking on the link for the Ministry for the Ecological Transition and the Demographic Challenge (bottom left of the screen): https://www.miteco.gob.es/en/cambio-climatico/temas/default.aspx

- A través de la página Web:

www.renade.es

What should I do if I forget my EU login password?

In the case that you need to request a new password to access the Website, you can request a new one through the tab:

You must follow the steps from the access manual created for this purpose. In order to obtain this and other help manuals, see point 9 of this document.

Remember that the password cannot include your name or surname and must contain a minimum of 10 characters and at least two of the following four combinations:

- Upper case letters from "A to Z"

- Lower case letters from "A to Z"

- Numbers from "0 to 9"

- Special characters: "*&%"

What is an emissions allowance?

It is the right to emit an equivalent tonne of carbon dioxide during a specified period. These were created within the emissions trading system established in the European Union through Directive 2003/87/EC.

There are two types of allowances: General allowances or "European Union Allowances" (EUAs) and aviation allowances or "European Union Aviation Allowances" (EUAAs). The aircraft operators can settle accounts for their emissions by surrendering both aviation allowances, as well as general allowances. Installations, however, cannot surrender aviation allowances.

What are the main Units contained in the Registry?

General Allowances (EUAs) and Aviation Allowances (EUAAs)- Explained in the previous section (point 6).

Certified Emission Unit (CER).- Issued by virtue of CDM projects. The Clean Development Mechanism (CDM) is detailed in article 12 of the Kyoto Protocol and is based on the investment of a developed country in a project for the reduction of emissions or carbon fixation in a developing country. In return for the investment, the developed country will receive the reduction credits associated to the emissions prevented or removed which it will be able to use to reach its reduction/limitation commitments. Both countries, the investor and recipient, must be parties to the Kyoto Protocol.

What is the allocation of emission allowances?

The allocation of emission allowances is the method by which emission allowances are placed on the market. Basically there are two options: free distribution between the affected installations (free allocation) and auctioning. The rules determining free allocation are common to all the installations throughout the member States. These rules are detailed in Decision 2011/278/EU and are implemented in a set of interpretive guidelines.

The owners of installations with a right to free allocation, (the generation of electricity is an activity that does not have any such right), will be able to request the individual allocation of emission allowances in accordance with article 19 of Law 1/2005, article 17 et seq (chapter IV) of Commission Decision 2011/278/EU of 27 April 2011, Article 9 of Royal Decree 1722/2012 of 28 October, and Guidance Document no. 7 on New Entrants and Closures prepared by the European Commission.

Where can I find the different user manuals?

Upon accessing the Registry, in the Help section (upper right of the screen), there is a link where you can find all the different user manuals.

Who has the obligation of opening an account in the Registry?

Any installation within the scope of application of Law 1/2005, of 9 March and which has a greenhouse gas emissions permit, is obliged to have a holding account in the name of the installation in the Spanish Section of the Union Registry.

Any aircraft operator within the scope of application of Law 1/2005 of 9 March and Law 13/2010 of 5 July, and which has an approved Monitoring Plan, is obliged to have an aircraft operator holding account in the Union Registry.

What is a Legal Representative?

The opening of an account requires the verification of the identification of the applicant, as well as the representatives authorised to act on its behalf, the power of attorney granted to the latter and the prior signature of a contract, in accordance with the model established in the annex, in which the obligations and rights of the parties are determined, pursuant to that established at any time by the applicable legislation.

The legal representative does not have access to the account. It is the figure to whom the following five specific powers are granted:

- Request that the Spanish National Administrator of the Union Registry open an Account in the Spanish Section of the Union Registry, sign the Account Opening and Maintenance Form and its Appendices, as well as any other necessary document and contracts;

- Carry out whatever actions are necessary to maintain and keep up-to-date the Account in the Spanish Section of the Union Registry, including its closure and, for this purpose, report any modifications to the information supplied to open the Account, as well as any other information which should be reported to the Spanish National Administrator of the Union Registry, in accordance with all applicable regulations;

- Receive all correspondence detailed in the regulations of the Spanish National Administrator of the Union Registry, addressed to the Account Holder, regarding the opening of the Account, its maintenance, updating, cancellation or any other related action;

- Appoint Authorised Representatives and/or Additional Authorised Representatives before the Spanish National Administrator of the Union Registry, authorising them to enter into transactions and other processes via the website of the Spanish Area of the Union Registry, as well as to use the username and password to access the Account Holder's Account in the Spanish Area of the Union Registry, and authorising them to dispose of emission rights and other Kyoto units registered in the Account; and

- Order the payment of fees owing to the Spanish National Administrator of the Union Registry in accordance with the provisions of prevailing legislation.

What is an Authorised Representative and what are their roles?

The authorised representatives are responsible for one or more accounts on behalf of the account holder.The following roles can be assigned to the authorised representatives:

- ROLE 1 (READ ONLY): can only access the account for the purpose of making consultations, cannot initiate or approve any process.

- ROLE 2 (PROCESS INITIATION ONLY): can only initiate processes from the account (i.e. propose a transaction), to be approved by a ROLE 3 or ROLE 4.

- ROLE 3 (PROCESS APPROVAL ONLY): can only approve processes initiated by another ROLE 2 or ROLE 4.

- ROLE 4 (PROCESS INITIATION AND APPROVAL): can initiate processes (to be approved by another ROLE 3 or ROLE 4) and approve processes initiated by another ROLE 2 or ROLE 4. Cannot approve processes they have initiated themselves.

The functions in which the authorised representatives are involved are:

Use of the access codes for the Account that the Account Holder has in the Spanish Section of the Union Registry.

- Initiate transactions and other processes using the website of the Spanish Section of the Union Registry.

- Adding trusted accounts.

- Surrender of allowances.

- Cancellation of units.

- Etc.

The authorised representatives and additional authorised representatives shall be natural persons over the age of 18. The member State of the national administrator may require that at least one of the authorised representatives of an account permanently reside in said member State, except in the case of verifier accounts.

How many Authorised Representatives are needed to open an account and what are their roles?

Pursuant to Article 20.2 of Delegated Regulation (EU) 2019/1122, the account must have at least two designated authorised representatives when it is opened, who may have the following rights in relation to performing processes from the account (including transactions):

- ROLE 1 (READ ONLY): can only access the account for the purpose of making consultations, cannot initiate or approve any process.

- ROLE 2 (PROCESS INITIATION ONLY): can only initiate processes from the account (i.e. propose a transaction), to be approved by a ROLE 3 or ROLE 4.

- ROLE 3 (PROCESS APPROVAL ONLY): can only approve processes initiated by another ROLE 2 or ROLE 4.

- ROLE 4 (PROCESS INITIATION AND APPROVAL): can initiate processes (to be approved by another ROLE 3 or ROLE 4) and approve processes initiated by another ROLE 2 or ROLE 4. Cannot approve processes they have initiated themselves.

For processes to be run, one of the following combinations of authorised representatives must be established:

- ROLE 2 + ROLE 3

- ROLE 4 + ROLE 3

- ROLE 2 + ROLE 4

- ROLE 4 + ROLE 4

Can there just be one Authorised Representative registered in the account? Check, Four-eye principle (Double validation)

Article 20 (4) of Delegated Regulation (EU) 2019/1122): Account holders may decide that the approval of a second authorised representative is not necessary to propose transfers for execution to accounts on the trusted account list set up pursuant to Article 23. The account holder may withdraw such decision. The decision and the withdrawal of the decision shall be communicated in a duly signed statement submitted to the national administrator.

Can an LR be an AR at the same time?

A legal representative may be an authorised representative of one or more accounts at the same time.

What is an account holder?

Individual or legal entity holding an account in their name in the registry system.

What is an installation operator?

Any individual or legal entity that operates or controls the installation, either as the owner, or under any other legal title, provided that this grant sufficient powers over the technical and economic operation of the installation.

What is an EU account?

The Union Registry consists of the registry of the transactions carried out within the framework of the European Union emissions trading system, acting as a sole "ETS registry" for all the member States.

EU Accounts

In the Union Registry, there are several types of accounts depending on the type of user and operability: The opening of installation operator holding accounts and the aircraft operator holding accounts is obligatory for these subjects, so that these may comply with the obligations imposed by the regulations relating to the EU emissions trading system. Whereas there are accounts that may be opened by any individual or legal entity wishing to participate in the trading system on a voluntary basis. These accounts are the trading accounts. These accounts are identifiable because their numbers begin with digits EU-100.

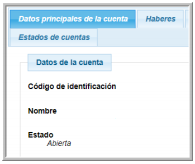

How can I access the account information in the Registry?

Access to the account information may be obtained in three different manners:

- The account number.- we can access the information on the account holder.

- The balance.- we can directly access the "Credit" tab, which details the account balance.

- The installation/aircraft operator indicator.- we can access data such as activity, identifier or permit status.

Having accessed the account, it is possible to browse all the tabs where all the account information is held.

What is compliance?

All installations subject to the emissions trading system through the performance of any of the activities generating greenhouse gases included within the scope of Law 1/2005 must comply with the obligations deriving from its inclusion therein. Among these obligations is that of surrendering, during the four months following the end of the calendar year, an amount of emissions allowances equivalent to the total verified emissions of the installation during the previous year (article 27, Law 1/2005). This process of surrendering allowances is known as compliance.

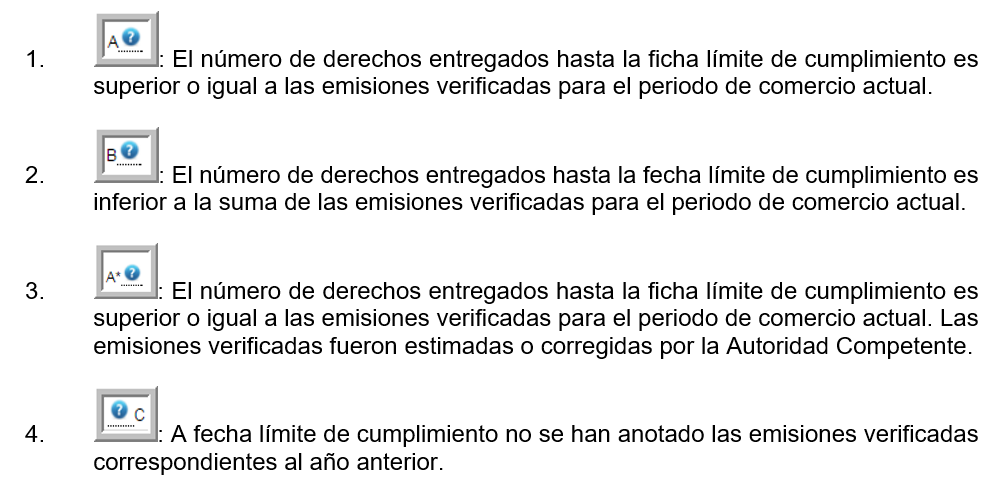

How can I check the compliance status?

The central administrator shall ensure that on 1 May of each year the Union Registry indicates the figure relating to the compliance status corresponding to the previous year for each installation operator and aircraft operator with an open or blocked holding account, calculating the total of all the emission allowances surrendered for the year in progress, less the total of all verified emissions for the period in progress up to and including the year in progress, plus a correction factor.

Compliance status figure for each installation and corresponding year. This figure will indicate whether the installation has surrendered an amount of allowances equivalent to the same data for the verified emissions detailed in its Registry account.

You can view the dynamic compliance status of the account, which may be one of the following:

When is the compliance history updated?

As indicated in the Registry application, the compliance history is updated every 15 May.

What is the deadline for surrendering allowances?

In accordance with article 27 of Law 1/2005 of 9 March, before 30 April of each year, the owners of installations and aircraft operators must surrender a number of emissions allowances equivalent to the verified emission data recorded in accordance with the provisions of article 23 of the aforementioned Law.

Is it possible to surrender the allowances before 1 April, even though the Competent Authorities have not validated the verified emissions?

Yes, it is possible to surrender the allowances before 1 April, even without the validation of the verified emission data by the Competent Authorities. However, in order not to incur any errors, the accuracy of the data that must be checked with the competent authority, as this may be subject to modification.

When are the verified emissions recorded in my account?

Before 31 March, provided that:

- Installations: the autonomous competent body has approved the verified emissions report presented by the installation. The annotation is the responsibility of the autonomous body.

- Aircraft operators: the Ministry of Public Works and Transport has issued a favourable report regarding the verified emissions report presented by the aircraft operator. The annotation is the responsibility of the OECC (Spanish Office of Climate Change).

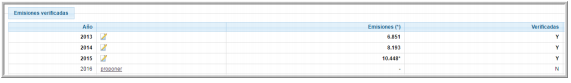

How can I check the verified emissions and the compliance within the Registry?

In order to check the verified emissions recorded for the installation/aircraft operator, you must go to the compliance tab, where the verified emissions appear listed by year:

In addition to the total verified amount, the total amount surrendered by the installation is also listed:

What happens if the verified emissions data is not recorded in the Registry?

In the case in which on 1 April of any given year the annual verified emissions relating to the previous year of an installation operator or aircraft operator have not been recorded in the Union Registry, the central administrator shall ensure that the Union Registry blocks the corresponding holding account of the installation operator or aircraft operator.

When all the verified emissions of the installation operator or aircraft operator for that year pending notification have been recorded in the Union Registry, the central administrators shall ensure that the Union Registry unblocks the account.

Can I request that Iberclear issue a certificate?

Iberclear, as the entity responsible for the Spanish Section of the Union Registry and the provision of the support service to the national administrator, can certify any transaction, balance or action carried out within the Spanish Section of the Union Registry.

To do so, the account holder must send an email to correo.titulares@renade.es detailing its request. The account holder will be sent an email with the steps to be followed..

What is the fee for a certificate?

The fees for issuing certificates under the provision of additional services, as set forth by article 4 of Order TEC/813/2019 of 24 July, concerning Fees for the Spanish Section of the Union Registry are:

- 1 Certificate: €60 + VAT,

- more than one certificate: €100 + VAT

What must I do to amend any data held on the Registry?

You must visit: www.renade.es

Can I abort a transfer?

Article 35 (5) of Delegated Regulation (EU) 2019/1122: The central administrator shall ensure that the Union Registry enables to abort a transaction, which is subject to execution rules set out in paragraph 3, before its execution. An authorised representative may initiate aborting a transaction at least two hours before its execution. If aborting a transaction was initiated because of suspected fraud, the account holder shall immediately report it to the competent national law enforcement authority. That report shall be forwarded to the national administrator within 7 working days.

What transactions can be cancelled?

In accordance with sections 1 and 2 of article 58 of Delegated Regulation (EU) 2019/1122 of 12 March 2019:

- If an account holder or a national administrator acting on behalf of the account holder unintentionally or erroneously initiated one of the transactions referred to in paragraph 2, the account holder may propose to the administrator of its account to carry out a reversal of the completed transaction in a written request. The request shall be duly signed by the authorised representative or representatives of the account holder that are authorised to initiate the type of transaction to be reversed and shall be posted within ten working days of the finalisation of the process. The request shall contain a statement indicating that the transaction was initiated erroneously or unintentionally.

- Account holders may propose the reversal of the following transactions:

- Surrender of allowances

- Deletion of allowances

Can I perform transactions outsilde the trusted account list?

- Article 55 (3) of Delegated Regulation (EU) 2019/1122: Holders of operator holding or aircraft operator holding accounts may decide that transfers are possible from their account to accounts not on the trusted account list set up pursuant to Article 23. Holders of operator holding or aircraft operator holding accounts may withdraw such decision. The decision and withdrawal of the decision shall be communicated in a duly signed statement submitted to the national administrator.

Do I have the obligation to update the documentation of the account?

Yes. In accordance with sections, 1 and 4 of article 22 of Delegated Regulation (EU) 2019/1222 of 12 March 2019:

- Account holders shall confirm to the national administrator by 31 December each year that the information for their account remains complete, up-to-date, accurate and true."

- At least once every three years, the national administrator shall review whether the account information remains complete, up-to-date, accurate and true, and shall request that the account holder notify any changes as appropriate. For operator holding accounts, aircraft operator holding accounts and verifiers, the review shall take place at least once every five years.

What are the possible statuses of an account?

The Union Registry distinguishes between the following account statuses: open, blocked, suspended and closed. You can check the status of your account at:

Active accounts (those that allow their representatives access) are considered to be those that have a status of "open" or "blocked". The representatives will not be able to perform any transactions from a blocked account, unless it is to surrender allowances (if they are able to receive allowances or KP units from other accounts).

Inactive accounts (those that do not allow their representatives access) are considered to be those that have a status of "suspended" or "closed". The representatives will not be able to perform any transaction from a suspended account (Article 9).

What is an excluded account?

When an installation/aircraft operator with an account open in the registry is excluded from the system, the status of the holding account associated to the installation/aircraft operator (installation holding account/operator holding account) changes to "excluded". The exclusion is a property of the account visible on the compliance tab, which implies that for the year during which the account shows as excluded, none of the following processes will be possible:

- Transfers of Kyoto (KP) units or emission allowances, (with the exception of the return of the same in the case of excess allocation).

- Receipt of free allocation:

- For installations. In the year in which they are listed as excluded.

- For aircraft operators, for the year following that in which they are listed as excluded.

- Annotation of emissions for the year of exclusion (if there are emissions, these shall not be considered for the compliance figure).

- Editing of any already noted emission.

- Cancellation of Kyoto (KP) units.